Contents

Perceptual Maps AND Who Are Our Competitors?

A good question for any organization to determine who are their competitors?

While this sounds like a very simple question, the identification of competitive sets is probably an area that is probably not addressed adequately when developing marketing strategy.

This occurs primarily because most firms simply identify their direct competitors as their only true source of competition.

But this is a very narrow view of the overall market and is quite unsuitable for the development of a professional marketing strategy and plan. And that’s where perceptual maps can be very helpful. Let’s find out more…

Look at Needs-Based Competitors

In reality, the firm’s competitive set should be based on the consumer needs and not just on similar product offerings. As an example, let’s use Coca-Cola. As we all know, their main direct competitor is PepsiCo, because they sell a similar cola beverage.

But we need to consider what is the prime underlying need/s of the consumer in their decision to purchase a beverage and then to choose between similar brands. Perhaps surprisingly there are a number of consumer needs in this regard, including:

- thirst,

- energy,

- refreshment,

- social status,

- alcohol mixer,

- beverage with a meal, and

- even hunger

For this example however, let’s concentrate on the main underlying consumer need, which is most likely thirst.

There are many, many products in the market that can fulfill this need. Obviously we have the whole range of sodas (soft drinks), as well as juices, water, energy drinks, sports drinks, milk-based drinks, and even alcohol.

If we keep extending this idea, we can see that hot drinks like coffee and tea will meet this consumer need. And there would even be some food items, such as ice-blocks and ice-creams, and potentially even soup that will also satisfy a consumer’s thirst. In other words, there are LOTS of potential competitors to consider.

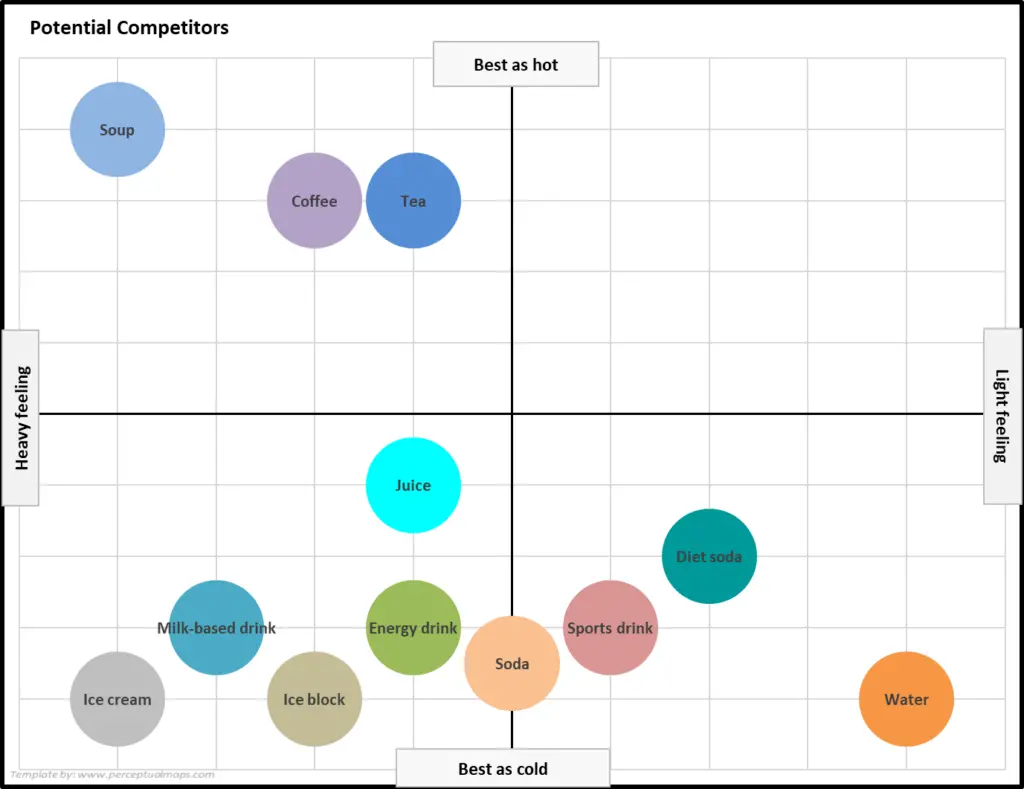

These product categories are shown in the following perceptual map.

Therefore, it should be clear that a brand can have a very broad range of competitors, which leads us to the concept of competitive sets. A competitive set is how the firm sees and classifies their broad range of competitors.

The above perceptual map highlights the range of competitors that could exist for a consumer simply looking to satisfy their need of thirst.

As you see on this perceptual map, there is a very broad range of competitors to consider, with each category overall being perceived as better as a hot or cold beverage, and then with varying degrees of light/heavy (= filling). This means that product categories – as well as brands and products – can fill a top-level positioning space.

Essentially in this case we are looking at the market at a product category level and we are less concerned with brands and individual product offerings at this stage. The main benefit of this style of perceptual map is that it provides a good overall understanding of all potential competitors for a firm.

We can also color-code this map and place these competitors into related sets of players (as shown in the following perceptual map). This allows us to simplify the market to some extent so that we can better develop suitable marketing strategies to differentiate and adapt to changing competitive offerings.

We can then continue to drill down. A good way to think about this process is like we are looking through a microscope and are increasing the magnification and are looking closer and closer at the market.

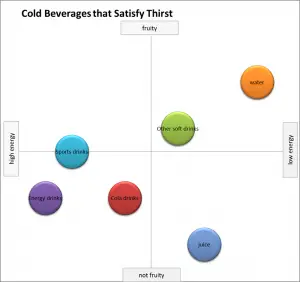

For our next view of the market and the related consumer need of thirst, let’s limit our view to just cold beverages. As a consequence, we will need to consider different and more relevant product attributes. For this example, we have used high/low energy and whether the taste can be fruity or not.

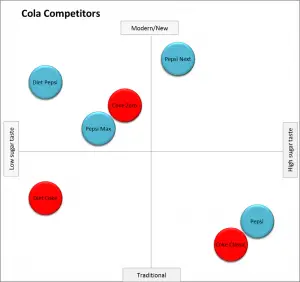

We can then continue to process of examining different competitive levels of a market. We could have a perceptual map that just shows soft drinks (as shown here) and we can even have a perceptual map that just looks at different brands of cola, as highlighted below.

Again, note how the attribute labels of the perceptual map are modified, this time to high/low sugar taste and modern/traditional. The brands of the two competitors (Coke and Pepsi) have been color-coded as well.

The Basics of Perceptual Maps and Identifying Competitor Sets

First, let’s define what a perceptual map is.

A perceptual map is a tool that helps marketers visualize how consumers perceive different products or brands in a market. Usually, you’ll see a map that shows a range of competitors and their product categories. For example, we’ve got some fast food players on the map: McDonald’s, Burger King, KFC, and Taco Bell.

Zooming in and Out

Think of a perceptual map like a microscope. You can zoom in and have a closer look or zoom out and take a wider view. Looking at all competitors on a perceptual map is just one layer or way to use this tool. To really gain insights, you need to zoom in and out of the map.

Direct Competitors

If you’re a company like McDonald’s, looking at all the competitors on the map may not be useful. So, zoom in and focus only on your direct competitors, like Burger King, Wendy’s, and In-N-Out. This will help you understand how your brand is perceived in comparison to your immediate competition.

Product Level

You can even zoom in further to the product level. For instance, we can look at specific products like the Big Mac, the Whopper, or the Zinger, and see how they’re perceived in the market. By understanding how consumers perceive different products, you can better cater to their needs and desires.

Indirect Competitors

Zooming out, we can look at indirect competitors or substitute competitors. These are other options that consumers might choose instead of fast food. For instance, someone might choose to go to a restaurant, cook at home, or go to a vending machine or café. By considering these indirect competitors, you can get a better understanding of the overall market and consumer behavior.

Why it Matters

Understanding how consumers make decisions is crucial for any company. By using perceptual maps, you can understand how consumers perceive different products and brands. This understanding will help you make better business decisions and tailor your marketing strategy to cater to consumer needs and desires.

A perceptual map is a powerful tool that can help you gain insights into the market. Rather than just looking at all competitors, try zooming in and out to gain a more comprehensive view. By understanding how consumers perceive different products and brands, you can make better business decisions and create marketing strategies that cater to consumer needs and desires.

FAQs for Perceptual Maps and Competitive Sets

What is a competitive set and why is it significant?

A competitive set is how a firm sees and classifies their broad range of competitors. It’s significant because it helps firms understand both their direct and indirect competitors, which is crucial for the development of effective marketing strategies.

What does it mean to look at needs-based competitors?

Looking at needs-based competitors means identifying competition based on the consumer needs that different products or services can fulfill, rather than just on similar product offerings. For instance, while PepsiCo is a direct competitor to Coca-Cola, any product that satisfies thirst can be considered a competitor.

How does the concept of competitive sets apply to Coca-Cola as an example?

For a company like Coca-Cola, their competitive set isn’t limited to just PepsiCo, their direct competitor. Any product that can satisfy the consumer need of thirst, including soft drinks, juices, water, energy drinks, sports drinks, milk-based drinks, and even hot drinks like coffee and tea, can be considered part of the competitive set.

How can perceptual maps be used to differentiate and adapt to changing competitive offerings?

Perceptual maps can be color-coded and competitors can be placed into related sets of players. This allows firms to simplify the market to some extent and better develop suitable marketing strategies to differentiate and adapt to changing competitive offerings.

How can different perceptual maps lenses and focus help identify competitors?

By zooming in on a perceptual map, a company can focus on its direct competitors. This will help the company understand how its brand is perceived in comparison to its immediate competition.

By zooming out on a perceptual map, a company can look at indirect or substitute competitors. These are other options that consumers might choose instead of a company’s product or service. By considering these indirect competitors, a company can get a better understanding of the overall market and consumer behavior.

Want More information? Check Out These Articles and this Video

- Get the Most Out of Your Perceptual Maps

- Perceptual Maps: Best Practice

- Top 12 Tips for Analyzing Perceptual Maps

- Free Download of the Perceptual Map Template